Everything is dumb because of the name cryptocurrency. No "crypto" in its current form will replace the fiat banking system and personally I think its a pretty dumb idea. I like bitcoin as a decentralised store of value, with the addition of being able to transact from places not connected to the traditional banking system. I think the idea of buying coffee with bitcoin is one of the stupidest things around and I think the larger group of cryptocurrencies is incredibly dumb, highly speculative and simply unnecessary. However, technological innovation is exciting, the decentralisation behind blockchains is really interesting and even the ICOs have some innovation, spreading the capital requirements of a startup across multiple people.

However, most of these projects are not decentralised. Most of the projects will not survive in the long run. I hold a significant number of projects I feel have a long term value of zero, or close to zero so I can sympathize with Acegooner, but his bias's are pretty obvious and it ruins this topic, and has continued to do so. His arguments largely come from generic statements and if I hear Buffet mentioned again I might burst into tears. He's regularly stated he thinks its a bubble for the last several years (article linked from 2014), but he seems to think bitcoin is a payment system, and the mainstream media are too lazy to seperate the assets. It seems silly to me to group Bitcoin and some of the shitty recent icos in the same "cryptocurrency" category. People involved in crypto certainly don't.

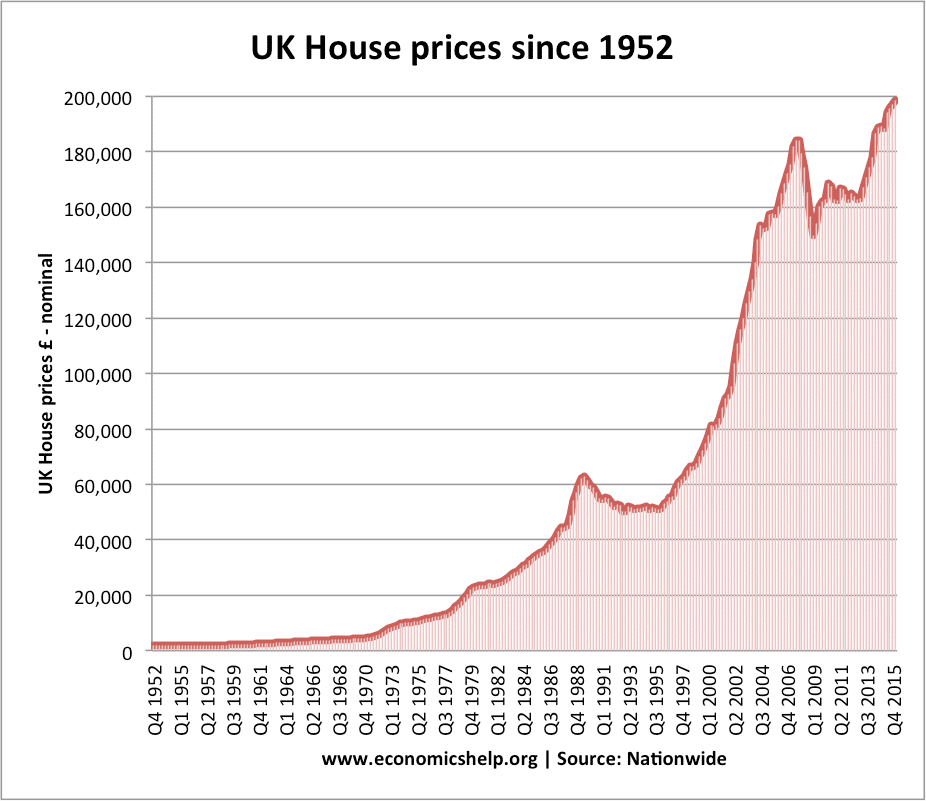

https://www.coindesk.com/legg-masons-bill-miller-buffett-wrong-bitcoin/Everyone needs to zoom out a little bit and get some dam perspective.

We hit lows not seen since late November.

The market is unregulated and therefore we have to assume manipulated, at least to some degree. (see Korean officials insider trading the ban to things like Spoofy)

Here is the best piece of work I have found on Cryptoassets and it is largely the long term view I subscribe to, which funnily enough is probably closer to Acegooner then he would realise. I only really believe in Bitcoin for the long term so I completely understand the cryptocurrency bubble perspective but I would highly recommend any investor to put a small piece of their portfolio into Bitcoin. Perhaps you could argue that the risk to return ratio at the current price isn't so great, but as the world becomes to accept Bitcoin as its own asset class, which I believe the CME/CBOE futures as well as current price indicates, not holding Bitcoin increases volatility of your portfolio dramatically. Scaling in steadily, perhaps with 33% of your position invested now after the recent drop in price, with a plan to pick up the next pieces over the next 2-5 years, depending on when the next bear market appears for Bitcoin. This is particularly important due to the early stages of the marketplace and the number of naive investors within the market that are chasing such returns. Further diversification may be required, but 99% of other cryptocurrencies are extremely correlated, and I can understand an investor not wanting to play a game of chicken with altcoins. I suspect when that bubble pops properly, which may not occur this year, many coins will go to 0. This isn't to say bitcoin isn't also correlated, but long term I believe it will separate itself from the majority.

"In contrast, the potential value of a winning monetary store of value protocol can be

measured in relation to the total value of gold bullion and foreign reserves, suggesting a

potential value in the USD 4.7 – 14.6 trillion range. If Bitcoin were to become that monetary

store of value (and it currently appears to be the strongest contender by some margin), it

could be worth USD 260,000 – 800,000 per BTC, i.e., 20 – 60x its current value. If one

places a higher than ~5% chance of Bitcoin succeeding in this way, it is a rational and

attractive investment for a long-term investor before considering other potential upsides

stemming from payments and unit of account utility"

Quote from a long term investment thesis written by John Pfeffer, not sure if he is well known but its the best analysis I have seen.

https://s3.eu-west-2.amazonaws.com/john-pfeffer/An+Investor%27s+Take+on+Cryptoassets+v6.pdfFinally 150 words by kadhim.shubber a writer for the Financial Times

| Click to see full-size image. |